Celebrating International Women's Day: The Actuarial Edge in a Data-Driven World

Women Leading the Way in Data-Driven Professions

International Women’s Day is a time to recognize and celebrate the achievements of women across all industries. One of the most remarkable trends in the modern workforce is the rise of women in data-driven professions.

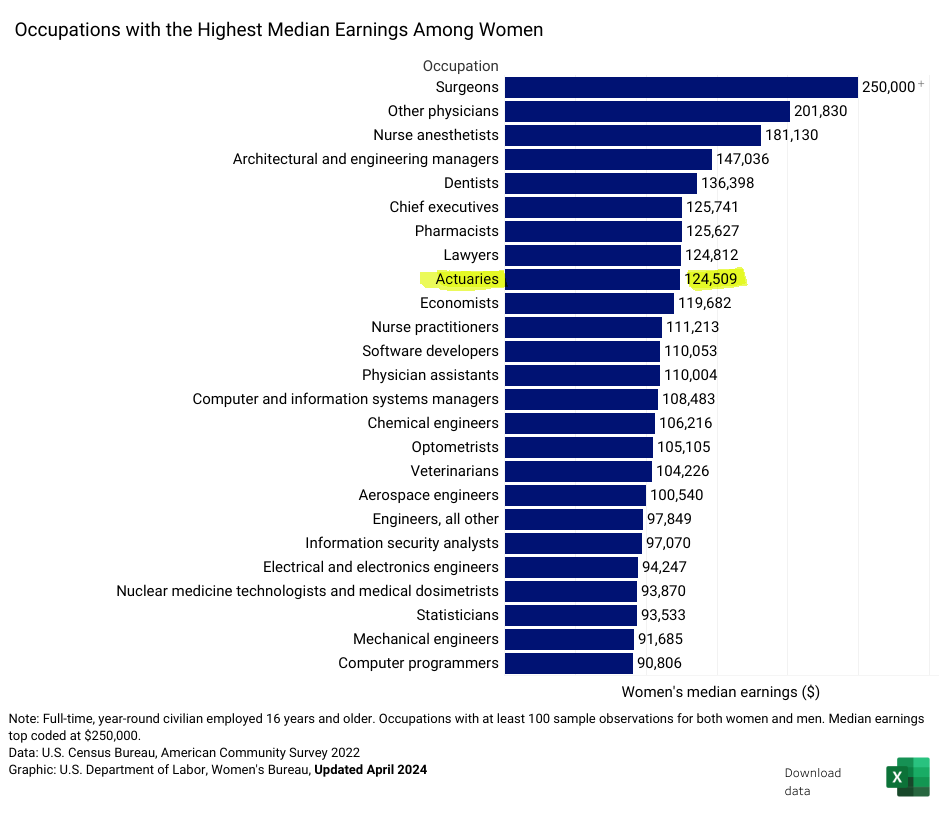

According to the

U.S. Census Bureau’s American Community Survey (2022) and the Department of Labor’s Women’s Bureau, among these, the actuarial profession stands out, ranking 9th with a median salary of $124,509. Actuaries play a crucial role in shaping industries through data analysis and risk assessment, influencing everything from insurance policies to climate risk management. With the actuarial field expected to grow by 22% from 2023 to 2033, far outpacing the average job growth rate of 4%, women in

actuarial roles are making an undeniable impact.

Actuaries: Architects of Stability and Security

Actuaries use mathematics, statistics, and financial modeling to assess risk and uncertainty. With approximately 2,200 new actuarial positions opening each year, the demand for these professionals highlights the increasing importance of data-driven decision-making in an unpredictable world. Women in actuarial science are leading the charge, leveraging data to drive meaningful change.

Breaking Barriers and Closing the Gender Gap

Historically, the actuarial profession, like many STEM fields, has been male-dominated. However, initiatives aimed at encouraging women in mathematics and analytical careers have led to significant progress. Organizations such as the Society of Actuaries and Women in Actuarial and Analytical Science are working to close the gender gap by promoting mentorship, scholarship programs, and networking opportunities for women in the field.

There are over 25,000 actuaries in the United States, with only 25.7% of them identifying as women.*

Additionally, companies that embrace diversity in leadership roles tend to perform better financially and foster more innovative decision-making. As more women enter the actuarial profession, they bring fresh perspectives and enhance the industry's ability to solve complex problems.

Celebrating Women in Data-Driven Careers

This International Women’s Day, we celebrate the women who are making strides in actuarial science and other data-centric professions. Their work ensures financial stability, manages risk, and drives progress in industries that shape our daily lives.

For young women

considering careers in data analytics,

finance, or risk assessment, the actuarial field offers a promising and rewarding path. By continuing to support and encourage women in these roles, we can build a more equitable and innovative future.